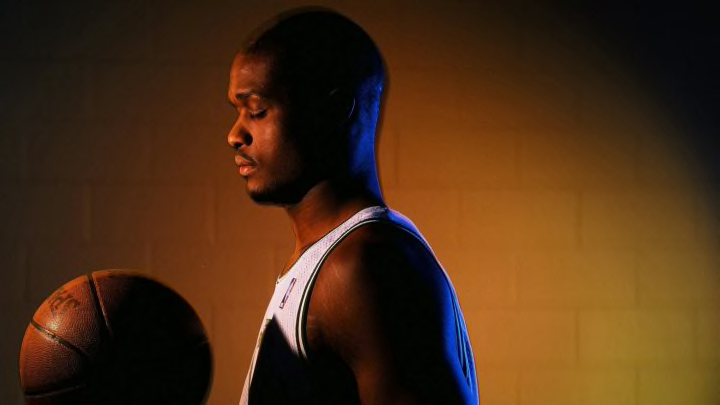

Letter to My Younger Self

Dear Toine,

It’s the summer of 2001 and you’re on top of the world. Michael Jordan is on his comeback tour, and you have spent the summer working out in Chicago with him and some NBA players from the area. You have already won an NCAA title at Kentucky, been taken sixth in the 1996 NBA draft by the Boston Celtics and made it to the All-Star Game … but getting the call from the greatest player of all time? (Yeah, he still is …) That’s about as good as it gets for a kid from inner-city Chicago.

And you have some great days ahead of you. In a few years, you’re going to win an NBA championship with the Miami Heat. You’ll make two more All-Star teams. You’ll be inducted into the UK Athletics Hall Of Fame.

But I don’t want you to focus on that. I want you focus on this moment you’re in right now, because you’re going to remember it as one of the best times of your life.

You’ve reached the highest level of your sport. Your contract pays $10 million this year and you are living very well (a bit too well, but we’ll get to that later). Even better, you’re making life more comfortable for your family. You are doing your part as a father, a brother, a cousin, a nephew, a friend and a son — especially as a son. You’re still proud that you were able to build a house for your mother from the ground up. You’ll never forget the day she moved in. You know she deserves it and much more.

But back to the moment you’re in now: You’re meeting some friends from the league at a restaurant tonight, and it will be another good time. But before you go, I want to teach you a new word, a word that you don’t have in your vocabulary yet. The word is no. I know this won’t be easy for you, so I want you to practice.

Say it: “No.”

Now try: “No, sorry, I can’t.”

And now: “No, I’m going to pass.”

Good … now let me tell you why I’m teaching you this invaluable new word.

Tonight, one of your best friends is going to bring along a buddy. This friend of a friend is good company, a nice guy. He seems to know a lot of people in the league, and he likes to bring them business ideas. He wants to swap phone numbers and stay in touch.

This would be a good time to use that word I just taught you.

Here’s what’s going to happen if you don’t: You’re going to trade texts, maybe run into him from time to time. He’s going to tell you about some real estate deals he’s been working on. The numbers will look good. You’ve been thinking that it’s time to make some money outside of basketball. Maybe you can live on that and set aside your NBA money for the future.

You and your new friend will start a company together. You’ll call it Walker Ventures. Sounds good, right? You’ll invest in commercial real estate, apartment buildings and other income properties. You won’t even have to put up any cash, just guarantee the bank loans with your personal portfolio. You’re playing basketball nine months out of the year, so he’ll take care of managing the properties. That will sound good enough to you at the time.

It will all go well, at first. You’re buying buildings. The equity keeps growing. No cash is coming out yet, but it will eventually come … at least that’s what you’ll think.

Then the troubles will start. Payments to the banks won’t get made. It’ll turn out that your “friend” has been mismanaging the properties and stealing from you, but you weren’t around to see it.

It won’t be long before Walker Ventures closes. But those loans you guaranteed will still need to be paid. So that’s where more than $20 million of that contract money will go. By then, that will be more money than you have left.

Your “friend” will be heading off to jail, and you will be on your way to bankruptcy court.

I know that this is going to be hard for you to believe, but you’re going to make $108 million playing basketball — $108 million — and a few years later, you’ll be broke. You trusted the wrong person, and you didn’t have anyone else watching the business. You might have been able to work through that, but you handed out too much money to too many people. And the rest, you either gambled away or spent on things that will eventually seem foolish.

So, let’s talk about your spending, how you’re living.

When you’re on the road — LA, Miami, wherever — you can’t take the 10 or so guys you run with to Gucci or Louis Vuitton and tell them to get whatever they want. I know it’s easy to get bored when you’re on the road, but those trips have to stop. You can’t afford it, especially if you’re also taking your guys to the club and spending thousands of dollars night … after night … after night. The clothes, the cars, the jewelry — all of it — you have to use that no word more often.

Sometimes, you even have to say it to yourself.

There will come a time in 2008 when over a six-week period, you’ll run up an $800,000 gambling debt at the casinos in Las Vegas. They’ll turn to a bank account of yours that they already have on file to collect, but by that time it will be an old account that you stopped using a while ago, so there won’t be enough money there to cover the debt. And do you know what happens when you don’t pay the casinos within 45 days? A warrant goes out for your arrest.

That’s when you’ll find yourself standing in front of a judge. And all that talent, all that opportunity … the judge won’t care about that.

The worst part is, this will come at the same time as your real estate troubles. The media will take notice, and they’ll run with it. You’ll see headlines nobody wants to see — headlines with your name, and words next to it like bankrupt or broke, or even lost everything.

You’re probably ready for some good news. Here it is: You don’t have to say no to everyone about everything. You were raised to think of your family first. Watching Mom raise six children as a single parent, you know what it looks like to make sacrifices to take care of your family. You want to help, and you should. Even after taxes and agents and everything else, $108 million is more than enough money to live well and take care of your family. So, buy Mom that house. She deserves it. Just don’t spend $800,000 on an indoor pool. She’ll still be very happy and very proud of you.

Here’s some more good news: You are smart enough to learn from your mistakes. That’s where I find myself today, where I’m writing you from. I’m sharing my experiences with college athletes, telling stories about my life — the life that will become yours if you don’t take my advice. And hopefully you can prevent some young athletes from making the same mistakes. Some of the kids I talk to remind me of you — of us. They have talent. They work hard and have bright futures … if they make the right decisions.

You have a good heart, but you also have to use your head. Learn to say no and practice it often. Even better, choose a financial advisor very, very carefully, and put him between you and the people asking you for money. It’s O.K. to try to make some money outside of basketball, but make sure that a third party who is not part of the deal can warn you of the risks. You’ve worked as hard as anyone to get where you are. Protect what you’ve earned.

And tonight … maybe you should just stay home and watch a movie.

Your friend,

Antoine

***

Antoine Walker is a 13-year NBA veteran who last played in 2010. He recently produced a documentary, Gone in an Instant, which chronicles his financial saga. He also works as a consultant with Morgan Stanley’s Global Sports & Entertainment Division to promote financial literacy among college athletes and professional rookies.